Single Page For All Web Stories

Get latest news and trends in a variety of topics, including technology, business, culture, cricket, movies, web series and more. Anima…

Honor V Purse Price In India 2024, Full Specifications, Features, Reviews

Are you tired of juggling between your bulky purse and smartphone? Say hello to the Honor V Purse – the ultimate solution to your everyday ca…

Top 5 Most Trainable Dog Breeds in the World

Training a dog can be a joyful experience, especially with breeds known for their intelligence and eagerness to learn. Here are the top 5 m…

Top 15 World's Most Viral & Loved Animals

In this blog, we explore the world of viral and beloved animals that have captured the internet's heart. These animals are not only adorabl…

The World's Most Dangerous Snakes With Their Images

The World's Most Dangerous Snakes: Unveiling the Top 10 Killers 1. Black Mamba: Location: Sub-Saharan and Southern Africa Size: U…

Top 10 Richest Person In The World 2023-2024

Who are the top 10 richest people in the world?(January 2024) Elon Musk Bernard Arnault Jeff Bezos Larry Ellison Mark Zuckerber…

Embed Web Stories In Your Blogger Blog

USA 3schools is a blog that provides readers with a comprehensive overview of the latest news and trends in a variety of topics, including techn…

The Ultimate Guide to Home Gardening: Tips for Beginners

This article is generated by ChatGPT & written using 3schools post editor . Instead of using Blogger default post editor, use 3schools p…

Paytm Payments Bank - What are the Options Before the Company?

1. Paytm founder, Vijay Shekhar Sharma, seeks extension and transition plan to meet RBI requirements by February 29.

2. RBI's restrictions halt new customer acquisition and transactions, leading to a 40% stock drop in three sessions.

3. Paytm generates revenue through UPI, net banking, credit cards, and wallets, emphasizing merchant services for profits.

4. Analysts highlight Paytm's profitable segments like cloud and commerce services amid RBI's licensing guidelines.

5. Regulatory concerns arise over PPBL's governance structure, ownership, and compliance with lending restrictions.

6. Money laundering fears surface as over 1,000 accounts are linked to the same PAN, prompting scrutiny.

7. PPBL holds 33 crore Paytm wallet accounts, facing challenges if unable to transition to another bank.

8. Transition options include seeking NPCI approval as a third-party UPI app or finding a new sponsor bank.

9. Loss of license necessitates a new sponsor bank to manage Paytm's operations, ensuring accountability.

10. Paytm aims to expand merchant services through third-party bank partnerships, enhancing infrastructure.

11. President and COO Bhavesh Gupta outlines a three-stage transition plan, focusing on partner integration and viability assessment.

12. The transition process entails finding a partner bank, evaluating commercial viability, and facilitating account migration.

Single Page For All Web Stories

Get latest news and trends in a variety of topics, including technology, business, culture, cricket, movies, web series and more. Anima…

The Ultimate Guide to Home Gardening: Tips for Beginners

This article is generated by ChatGPT & written using 3schools post editor . Instead of using Blogger default post editor, use 3schools p…

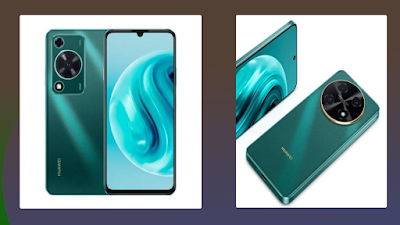

Huawei Enjoy 70 Pro - Full phone specifications & release date

Huawei Enjoy 70 Pro is here to dazzle with its stunning display, powerful camera system, smooth performance, and competitive pricing. It's a…

Top 5 Most Trainable Dog Breeds in the World

Training a dog can be a joyful experience, especially with breeds known for their intelligence and eagerness to learn. Here are the top 5 m…

Honor V Purse Price In India 2024, Full Specifications, Features, Reviews

Are you tired of juggling between your bulky purse and smartphone? Say hello to the Honor V Purse – the ultimate solution to your everyday ca…

The World's Most Dangerous Snakes With Their Images

The World's Most Dangerous Snakes: Unveiling the Top 10 Killers 1. Black Mamba: Location: Sub-Saharan and Southern Africa Size: U…